Our review on SumUp Payments Plus

SumUp launches a subscription offer: SumUp Payments Plus! For £19 per month, merchants can benefit from reduced commissions and even terminals at discounted prices.

SumUp Air |

|

| Transaction fee: 1.69% Price: £25 + VAT £14.99 + VAT To SumUp |

SumUp Solo |

|

| Transaction fee: 1.69% Price: £79 + VAT £29 + VAT To SumUp |

SumUp Terminal |

|

| Transaction fee: 1.69% Price: £85 + VAT £135 + VAT To SumUp |

SumUp changed the game with their straightforward deal: no fees, no commitment, and huge success in recent times.

This new offer demonstrates SumUp’s desire to try to conquer merchants with larger cash flow volumes.

SumUp is popular among small businesses for payments. Is the SumUp Payments Plus subscription right for you? We decrypt this new offer to help you choose.

For more information: complete review on SumUp.

Details of the SumUp Payments Plus subscription offer

SumUp designed the SumUp Payments Plus subscription for larger SumUp merchants.

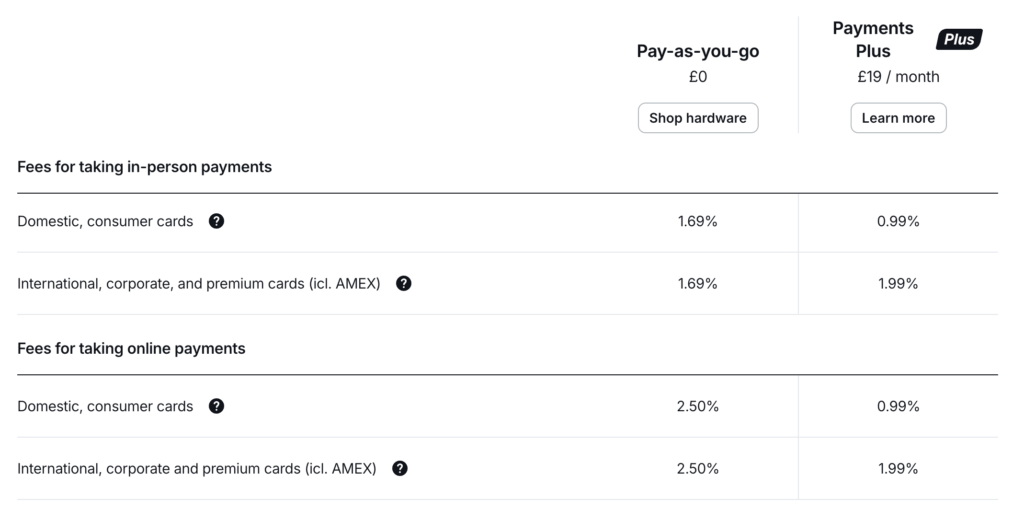

For a £19 month subscription, you get:

- Card reader and online payments will incur lower fees for transactions, charging just 0.99% on domestic cards.

- They transfer your cash receipts within 24 business hours.

- A 50% discount on the purchase of the SumUp payment terminals

- An unlimited number of digital invoices via SumUp Invoices

Important : International and commercial cards (including American Express) incur a 1.99% transaction fee! Therefore, the rate is particularly interesting if you have a majority of domestic cards. If this is not the case, the fees will increase quite quickly.

Visa and MasterCard charge more for international and business cards. So SumUp charges higher fees for transactions with those cards.

How to subscribe to the offer

If you are not yet a SumUp customer, you can choose to sign up during registration.

If you already have a SumUp account, go to your online space, then go to settings and choose the SumUp Payments Plus menu.

SumUp will debit your subscription every month at the beginning of the billing period. The subscription is non-binding; you can cancel the Payments Plus offer whenever you desire. When you cancel your subscription, you revert to the classic SumUp offer.

Get a 50% discount on the SumUp terminals by registering for SumUp Payments Plus and receiving a special code. The discount will be effective when you use this code.

Comparison versus classic SumUp

How to choose between the offer and the no-subscription offer?

We detail in this table the differences of the offers:

If you are already a SumUp customer, the question will be an economic equation. From what amount cashed do the savings made on commissions cover the £19 per month subscription?

If you have cashed only domestic cards, then with SumUp Payments Plus you save 0.70% on each transaction (0.70% = 1.69%-0.70%). Therefore you need to cash at least £2714 (19/0.70%) per month for this offer to be more interesting.

We can round this figure to £3000 per month considering the weight of corporate and international cards.

So, if you are a SumUp customer and you regularly cash in more than £3000 per month, then you should subscribe to SumUp Payments Plus.

Other reasons to switch to the Payments Plus offer:

- Retrieve your funds within 24 hours instead of 48 to 72 hours

- If you do a lot of e-commerce payments: here the saving is more significant. From 2.5% to 0.99%, i.e., 1.51%!

If you deposit over £3000, SumUp Payments Plus will rival services for bigger businesses like traditional bank offerings.

SumUp Payments Plus vs bank offers

A vast majority of merchants equip themselves with payment terminals via their bank. The traditional bank offer is as follows: renting a payment terminal for several years and competitive commissions.

The main argument of the banks is that of commissions. A bank can offer you a commission lower than 0.69%.

See if SumUp’s product quality is better than what banks offer. This includes terminals, software, and e-commerce services. Determine if this argument is stronger.

Moreover, the bank offers often come with a commitment, which is not the case with SumUp..

Conclusion

SumUp Payments Plus improves SumUp’s services, helping businesses with more money coming in to stay in the modern SumUp system. The complete SumUp solution with cash register software, billing software, e-commerce starts looking attractive. SumUp maintains the lead over its American competitor Square.

If you use SumUp and make over £3000 a month, you should switch to the Payments Plus subscription.